- Home

- About us

- Services

- Foreign services

- Non-Lucrative Visa

- Student Visa

- Family card of an EU citizen

- Family Reunification

- Residency permit for employees or self-employed persons

- Residence for professional internships

- Job search

- Long-term residence or long-term EU residence

- Expungement of criminal records

- Renewal of permits

- Roots procedure: Social, Labor, Family, training

- Spanish nationality

- Marriage and civil partnership

- Entrepreneurship law

- Foreign services

- Insurance

- Property search services

- Testimonials

- Blog

- Contact Us

- Book your appointment

English

English

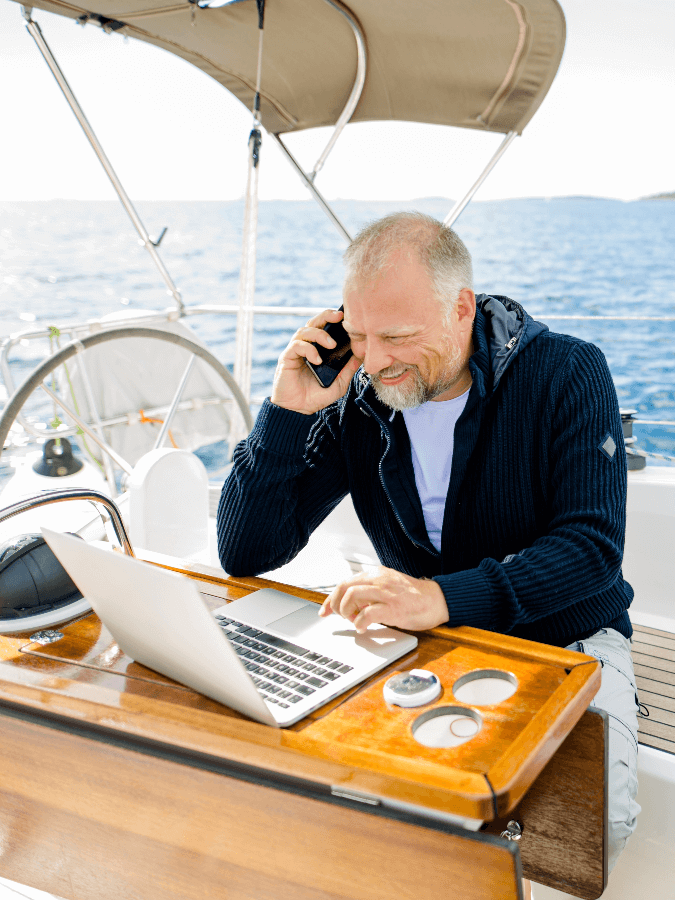

Exploring the Tax Advantages of the Spanish Digital Nomad Visa

Are you considering a move to Spain as a digital nomad? The new Spanish Digital Nomad Visa (DNV) is not just a ticket to the sun-soaked lifestyle of Spain; it’s also a gateway to unique tax advantages that set it apart from other visas. Designed to attract talented professionals, the DNV offers a financial incentive that’s hard to overlook.

The Tax Advantages of the DNV

At the heart of the DNV’s appeal is its significant tax benefits. Modeled after the Beckham Law and inspired by the UK’s Non-Domiciled taxpayer scheme, the DNV creates a unique fiscal position for its holders. As a digital nomad under this visa, you’re treated as a non-fiscal resident for tax purposes, yet fully resident administratively. This subtle yet powerful distinction opens up a world of tax benefits:

The Beckham Law

The Beckham Law, a pivotal component of Spain’s new Startup Law, has significantly widened its scope, making it more accessible to a broader range of foreigners, including digital nomads. This special tax regime is particularly advantageous as it allows individuals to be taxed as non-residents, despite spending more than 183 days in Spain, but how do you know if you qualify for the Beckham Law? Here are the main requirements.

- You must not have been a legal resident in Spain for the past 5 years.

- Reason you are moving to Spain must be work-related (applicable to remote workers).

- Application for this regime must be submitted within 6 months of receiving a positive resolution for the digital nomad visa.

Worldwide Income Tax Exemption

Just like the UK’s non-domiciled scheme, income and assets you hold abroad remain untaxed under the DNV. This means your global income sources enjoy tax-exempt status, a significant advantage for digital nomads with income streams from various countries.

Favorable Tax Rate on Spanish Income

For income earned remotely in Spain for a foreign employer, DNV holders benefit from a flat tax rate of 24% on the first €600,000 of gross annual earnings. This contrasts with the progressive rate, which can reach up to 50% with each tax bracket change. This flat rate, applicable for a five-year period, offers significant savings compared to standard tax rates.

Exemptions from Standard Tax Requirements

Unlike regular Spanish tax residents, DNV holders are not required to file a 720 tax return or pay Wealth Tax. This simplification of tax obligations is a huge plus, easing the administrative burden.

Deferred Tax Payment Options

Recognizing the challenges of settling into a new country, the DNV allows you to defer tax payments for the first and second year without incurring penalties or delay interests. This flexibility is crucial for those in the initial stages of their relocation.

Tax Residency Recognition

For other tax agencies, holding a DNV means you’re considered a tax resident in Spain. This can be advantageous in establishing a clear tax status globally.

The Spanish Digital Nomad Visa is more than just an opportunity to enjoy the vibrant culture and beautiful landscapes of Spain; it’s a financially savvy choice for those looking to optimize their tax situation. With the DNV, Spain is not only inviting skilled professionals to its shores, but also offering them a financially attractive package to make the move smoother and more rewarding.

Please note that the information provided in this blog represents the current understanding and interpretation of the Spanish Digital Nomad Visa’s tax advantages as of the date of publication. Tax laws and visa regulations are subject to change, and individual circumstances can significantly impact how these laws apply to you.

For the most current and personalized information, tailored specifically to your individual case and needs, we highly recommend scheduling a consultation with our experts.

Docs

Docs  Support

Support